Happy Friday! Today is National Junk Food Day. No. Just, NO.

1 big thing: Biden goes after rental junk fees

As announced by the White House on Wednesday, the Biden administration is taking steps against junk fees on behalf of renters as they’ve done for hotel guests and airline passengers.

Folks are tired of being played for suckers.

– President Biden at Wednesday’s meeting of his Competition Council

State of play: Florida has no limit on what landlords can charge for an application fee. Tenants nationwide are reporting that they’re being charged high application fees for background checks, plus additional fees for mail sorting, trash pickup, and other services that weren’t disclosed when they were deciding where they could afford to rent.

Rental application fees are running as high as $100 in some places, and — when tenants are applying for multiple locations with different management companies or landlords — the burden can be impossible to bear.

This compounds when the actual background check costs the landlord $20 or less to run, allowing the landlord or management company to make large profit margins by taking applications from multiple potential tenants for the same rental.

Some landlords require that rent be paid electronically and then charge tenants a “convenience fee” for accepting payments in that manner.

Some landlords are charging “January Fees” in addition to rent. No one is really sure what those cover.

To combat the effect of such fees:

Zillow, Apartments.com, and AffordableHousing.com have all agreed with the White House to disclose all upfront costs.

The White House is encouraging state legislatures across the U.S. to examine such fees being charged and pass legislation to regulate the practice.

And new research from HUD provides a blueprint for a nationwide effort to address rental housing junk fees.

The big picture: This is not the first time the Biden administration has taken on junk fees. With similar action from the Bully Pulpit, they have brought transparency to total costs for concert and event tickets, hotel charges, and airline fees.

No one agrees actually to eliminate or even lower the junk fees, and no laws are passed to prohibit them either.

The online sites that sell the services, however, agree to publish the fees upfront so consumers aren’t surprised later by the additional fees.

What’s the highest fee you’ve seen charged for a tenant application?Your response is anonymous |

2. Economic good news

Economic numbers are great across the board, and it looks like that recession that we were fearing isn’t going to happen after all.

Why it matters: Overall, people feel good about their own finances but have an impending sense of doom about the rest of the economy. But is that feeling justified by the numbers?

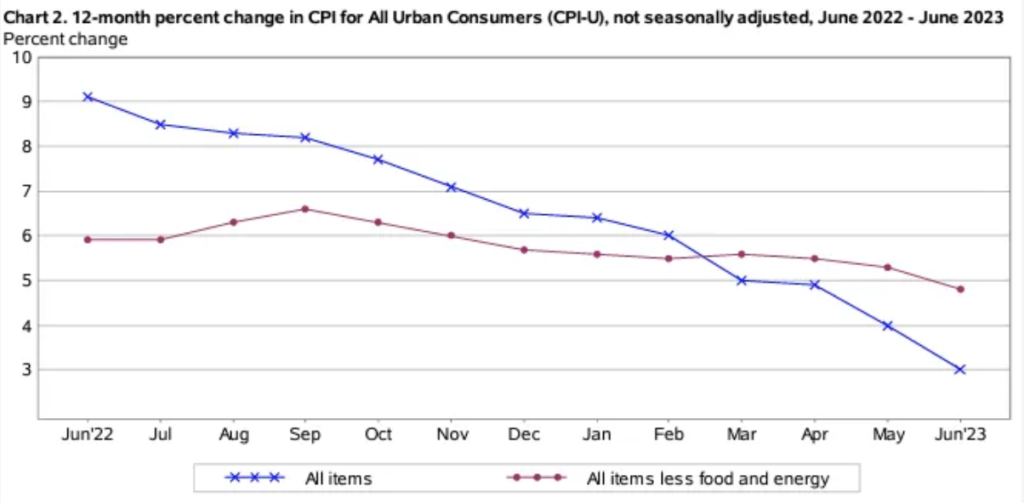

By the numbers: Price stability is settling back to normal.

While prices are still high for some goods and services, inflation is about how quickly prices are rising.

In the past month, prices rose by 0.2%, a barely noticeable range for most consumers.

This comes in at an annualized 3% inflation rate which is one point above the 2% the Fed is charged with holding.

Layoffs have hit the media and technology sectors, but those sectors have the largest megaphones to broadcast the news of those layoffs, so they seem to be widespread. The national unemployment rate is 3.6%, which is the lowest it has been since 1969.

The rest of the economy is adding jobs, with over 209,000 created in June. And they’re good-paying jobs because of huge investments in infrastructure and manufacturing.

The monthly civilian labor force participation rate is at 62.6% as of June. That’s where it was right before the pandemic.

Americans’ bank accounts are an average of 10 to 15% higher than they were in 2019.

Consumer sentiment is at a 22-month high.

And compared to our counterparts in the rest of the G7, the United States is killing it economically.

Yes, but: The consensus is that the Fed will raise its lending rate again next week, but (we hope) this will be the last increase this year.

Some Fed members are concerned that — unless they cause a lot of people to lose their jobs — inflation will keep rising. This kind of thinking could drive us into a recession.

But as you can see from the numbers above, that’s not happening. Inflation is no longer increasing at the same rate it was, and numbers are as good or better than they were before the pandemic.

The bottom line: If the Fed can shake its belief that no recovery can occur without major job losses, then we can finally put behind us the previous recession that COVID caused.

Our thought bubble: Economic stability breeds confidence, and confidence stabilizes the housing market along with other sectors.

3. Catch up fast

4. Pic of the day

Humility is one of the most important traits that a leader, entrepreneur, or anyone else can possess.

Why it matters: If a person is humble, they can accept and use:

feedback;

setback;

failure;

coaching;

others’ ideas.

More importantly, a humble person can admit mistakes, learn from them, and move forward. It breeds empathy.

Humble people use the words “we” and “our.” They’re not focused on “I’“or “me.” They share the spotlight and, more importantly, shine it on others around them.

The bottom line: Organizations are a reflection of those who lead them. Those led by people who embrace humility as a core cultural value tend to be some of the best places to work and thrive. They also generate happier customers and constituents.